Did you know that concrete is responsible for 8% of the world’s CO₂ emissions and is the second most-used substance in the world after water?

Reducing CO₂ emissions from cement manufacturing is particularly challenging because they result from the release of CO₂ during the conversion of CaCO₃ (calcium carbonate). ⅔ of the direct emissions come from the calcination of limestone into cement clinker during the burning process in the cement kiln. As we cannot change chemistry, these emissions are unavoidable. This makes the cement industry a hard-to-abate sector.

The industry is subject to the EU Emissions Trading System (ETS), receiving a limited number of allowances in exchange for being permitted to emit CO₂. Cement plants are facing increasing pressure to lower their emissions as the number of allowances decreases each year.

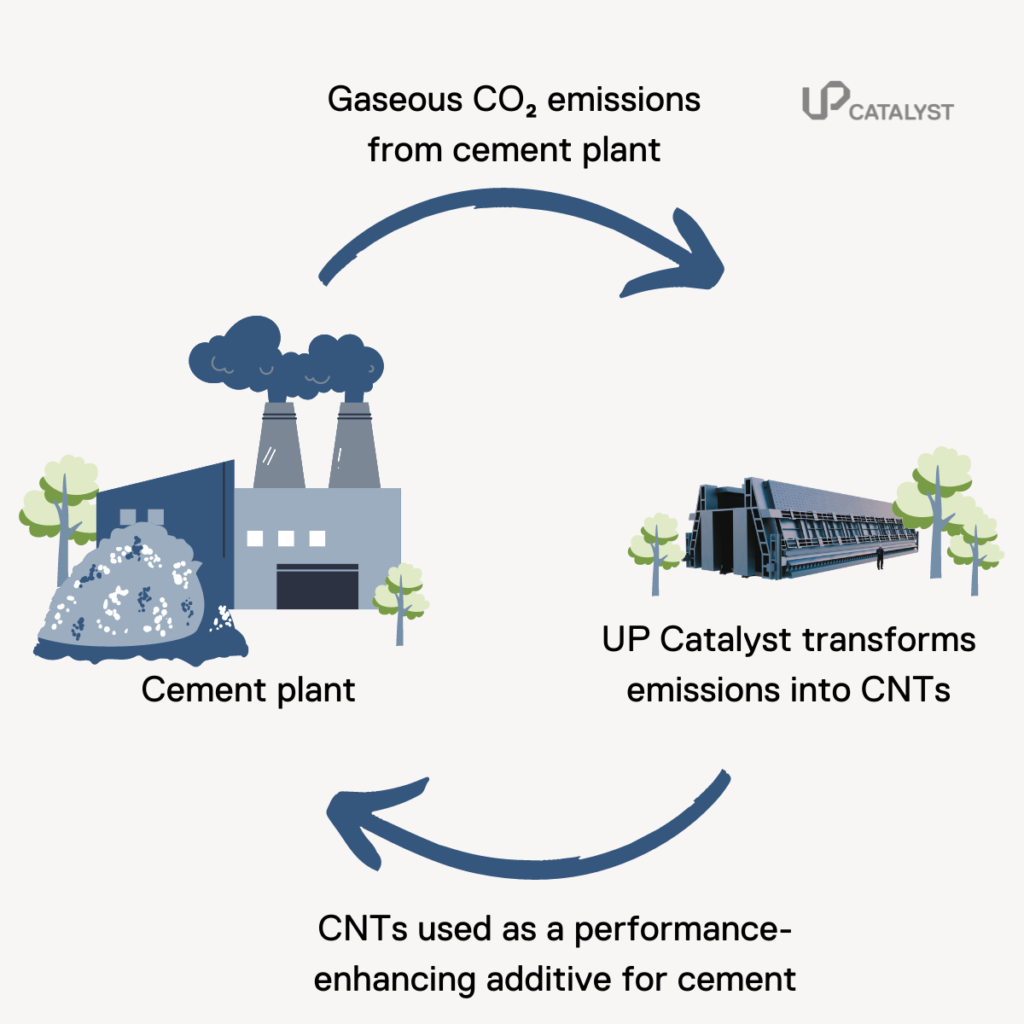

Achieving net-zero emissions in cement and concrete production requires the implementation of Carbon Capture, Utilisation, and Storage (CCUS) technologies. One of the most promising approaches is utilising CO₂ emissions from cement plants to produce materials that can be used by the cement industry. One such product is carbon nanotubes (CNTs).

Why CNTs?

CNT additives improve different concrete properties:

- CNTs strengthen concrete by significantly boosting its tensile strength and preventing cracks and allow for decreased material usage and lower emissions during production.

- CNTs can fill internal pores and promote cement hydration reactions.

- Carbon nanotubes can reduce the permeability of concrete, further enhancing its durability.

- Adding CNTs to concrete can improve its electrical conductivity.

- CNTs can improve thermal conductivity of concrete.

Top 10 cement companies to use sustainable carbon nanotubes from its own CO₂ emissions in 2030

All European cement plants already put effort into reducing their CO₂ emissions, implementing carbon capture technology onsite with the final goal to become climate-neutral by 2050.

1. HeidelbergCement

Heidelberg is one of the leaders in sustainable cement and is testing various CCUS technologies in different plants.

The company has partnered with a decarbonisation technology company, Leilac, that stands for the Low Emission Intensity Lime and Cement. The project addresses the unavoidable CO₂ emissions from limestone. Unlike other carbon capture technologies that require additional energy, Leilac ensures the captured CO₂ is pure and requires minimal energy. Leilac-1 is piloted at the Heidelber Lixhe plant in Belgium with the design capacity to capture 25,000 tonnes of CO₂ per year.

Leilac-2 will be implemented in the Ennigerloh plant in Germany with capturing capacity of 100,000 tonnes per year.

Leilac-3 would be the final scale up step for the Leilac technology. A Leilac-3 plant could potentially capture between 0.5–1 million tonnes of unavoidable process CO₂ emissions per year, depending on the size of the host plant.

In partnership with Linde, Heidelberg is building a large-scale CCU facility in a Lengfurt cement plant in Germany, set to start operations in 2025. The project will capture around 70,000 tones of CO₂ annually. This pure gas can be used in both the food and chemical industries. A smaller proportion will be used by Heidelberg for CO₂ recycling and recarbonation technologies.

As a part of Norwegian government’s Longship programme, Heidelberg is testing CCS technology in a Norway Cement plant in Brevik. 400,000 tonnes of CO₂ per year will be captured and stored, which corresponds to 50% of the plant’s emissions.

Those are just several examples of many Heidelberg cement plants across Europe that test different CCUS strategies to reduce emissions from production.

How Heidelberg could benefit from turning CO₂ emissions into CNTs?

Heidelberg Materials would benefit greatly from converting part of the CO₂ emissions into valuable carbon nanotubes, particularly at plants where geological CO₂ storage is planned. A UP Catalyst facility could be placed next to one of the Heidelberg plants, supplying all Heidelberg European cement plants with carbon nanotubes.

2. SCHWENK Cements

SCHWENK has plants in various European countries, including a plant in Latvia and another in Lithuania. Both plants are part of the CCS Baltic Consortium, a project aimed at building CO₂ transport and sequestration infrastructure in the region.

CO₂ will be captured from the Latvian and Lithuanian cement plants, liquefied, and stored in buffer storage located beneath the cement plants. Subsequently, the liquid CO₂ will be transported by rail or trucks to the port of Klaipėda, Lithuania. From there, the CO₂ will be transported by ships to a permanent offshore storage facility.

How SCHWENK could benefit from turning CO₂ emissions into CNTs?

As geological storage is prohibited in the Baltics, there is significant potential for CO₂ utilization by converting CO₂ emissions into carbon nanotubes. This approach eliminates the need for transportation infrastructure and generates additional revenue for the company instead of incurring expenses for CO₂ transportation.

3. Holcim

Holcim is advancing CCUS technology with more than 50 projects around the world, committed to capture more than 5 million tons of CO₂ annually by 2030.

Some of the Holcim project examples are:

ECCO2 in Spain, where Holcim together with Carbon Clean and Sistemas de Calor have implemented CCUS technology in a cement plant in Almería to capture 70 000 tons of CO₂ annually;

GO4ECOPLANET in Poland. A project aims to fully decarbonise cement production at the plant in Kujawy, capturing 1.2 million tons of CO₂ per year by 2027.

GO4ZERO project in Belgium, which aims to capture and store under the North Sea around 1.1 million tons of CO₂ per year by 2029.

Carbon2Business in Lägerdorf, Germany aims to capture 1.2 million tons of CO₂ emissions per year by 2029. The captured CO₂ will be repurposed as an industrial raw material.

C2PAT in Austria, aiming to 750,000 tons of CO₂ annually by 2030. The aim is to use the captured CO₂ in combination with green hydrogen produced by Verbund.

How Holcim could benefit from turning CO₂ emissions into CNTs?

Conventionally produced fossil-based carbon nanotubes entail high CO₂ emissions as the conventional process is very energy-intensive. On average, producing 1 ton of CNTs emits 200 tons of CO₂-eq. Holcim could convert part of its emissions into sustainable, climate-neutral (for Scope 1, 2, and 3) CNTs to improve concrete and cement properties.

4. Buzzi Unicem

Buzzi Unicem aims to utilise 1% of its CO₂ emissions by 2030, with a target of 48% by 2050. To achieve this, the company has been participating in various research projects.

One such project is CLEANKER, which captures CO₂ from a portion of the flue gas at the Buzzi Unicem cement plant in Vernasca, Italy.

Additionally, Buzzi Unicem is involved in the HERCCULES project, which focuses on reducing emissions from cement production and exploring waste-to-energy solutions.

Recently, the company’s subsidiary Deuna Zement announced a €350 million investment to install a carbon capture system at its cement plant in Deuna, Germany. This system will capture approximately 280,000 tons of CO₂ by 2030 and convert it into liquid CO₂. The captured CO₂ is considered be used for utilisation: emissions will be transported to the Middle East. The CO₂ will be used to produce “green CH4” out of “green H2” using solar energy. Methane will return to Europe with the same ships.

How Buzzi Unicem could benefit from turning CO₂ emissions into CNTs?

The Deuna plant is an excellent opportunity for Buzzi Unicem to test the production of carbon nanotubes from CO₂ emissions right next to the cement plant, eliminating the need for transporting CO₂ emissions to the Middle East. The UP Catalyst production facility can utilize all the emissions to produce CNTs, which could be used either for the cement plants or as an additional revenue stream.

5. Vicat

Vicat is a French company manufacturing cement, aggregates, and ready-mix concrete. Vicat is a member of CO₂ Value Europe, a non-profit association representing the CCU community in Europe.

In partnership with Hynamics, a subsidiary of energy provider Groupe EDF specialising in hydrogen production, Vicat is developing the Hynovi project at Montalieu-Vercieu cement plant in France. Solution will capture CO₂ from the plant and produce 200,000 tons of carbon-free methanol, i.e. a fourth of France’s total consumption.

6. Titan-cement

Titan-cement is a Greece manufacturer. Alongside Buzzi Unicem, Titan is a member CCUS collaborative research project HERCCULES.

IFESTOS is a large scale project in Kamari plant to capture 1.9 million tons of CO2 per year. Under this project, captured CO₂ will be liquified and transported to a permanent storage site in the Mediterranean.

How Titan-cement could benefit from turning CO₂ emissions into CNTs?

To diversify the CO₂ utilisation, Titan could test a portable container reactor that could be located just next to the cement plant to produce valuable carbon nanotubes.

7. Cementir

Cementir manufactures cement and concrete, principally in Turkey and Denmark. Cementir launched CCS pilot project at its Aalborg plant, Denmark, in 2022. The pilot plant will capture 360 tons of CO₂ per annually. If successful, the project could be scaled up with the potential to capture 400,000 tons of CO2 per year by 2030.

How Cementir could benefit from turning CO₂ emissions into CNTs?

Even though geological storage is more readily available in the Nordic countries due to former oil and gas reservoirs and existing infrastructure, these countries also have a high ratio of clean energy. This means CO₂ emissions could be converted into climate-neutral carbon nanotubes that could be sold on the European market, thus saving millions of tons of CO₂ emissions. Conventional fossil-based carbon nanotubes that are currently imported to the EU emit over 200 tons of CO₂-eq per ton of carbon nanotubes produced.

8. CRH

CRH is an international group of diversified building materials businesses with headquarters in Ireland.

K6 EQIOM, from the CRH Group, is participating in a project together with Air Liquide, to capture around 800 000 tons of CO₂ per year at the Lumbres plant in Northern France. Once purified and liquefied, CO₂ would be transported via shipping to permanent storage sites currently under development below the North Sea or would be utilized in building materials.

How CRH could benefit from turning CO₂ emissions into CNTs?

To avoid emissions from CO₂ transportation to the North Sea, emissions could be utilised onsite.

9. Lhoist

Rheinkalk GmbH, a German subsidiary of the Lhoist Group, a global leader in lime, dolime, and minerals.

The project EVEREST in Wülfrath, Germany, will cover the full CO₂ value chain from an inland lime plant: capture, liquefaction, pipeline transport, shipping, and offshore geological storage.

How Lhoist could benefit from turning CO₂ emissions into CNTs?

Local EV battery manufacturers could use climate-neutral graphite and CNTs.

10. Cimpor

Cimpor is the largest Portuguese cement group, aiming to reduce its CO₂ emissions by 37% by 2030 and achieve carbon neutrality by 2050. To meet these environmental targets, the company commits to investing around €130 million into modernizing industrial assets by 2030. One of their key goals is CO₂ capture in concrete.

How Cimpor could benefit from turning CO₂ emissions into CNTs?

Cimpor can convert part of its CO₂ emissions into valuable carbon nanotubes that strengthen concrete. By 2030, UP Catalyst plans to offer different sizes of reactors capable of utilizing between 60,000 and 220,000 tons of CO₂ annually. This approach will not only help in reducing emissions but also provide enhanced properties to concrete, thus contributing to the company’s sustainability goals.